how to answer are you exempt from federal withholding

If youre exempt from withholding meaning you didnt pay any federal income taxes last year and dont expect to owe any this year you can choose not to have any federal. Being tax-exempt means that some or all of a transaction entity or persons income or business is free from federal state or local tax.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

These employees include diplomatic and consular officers nondiplomatic.

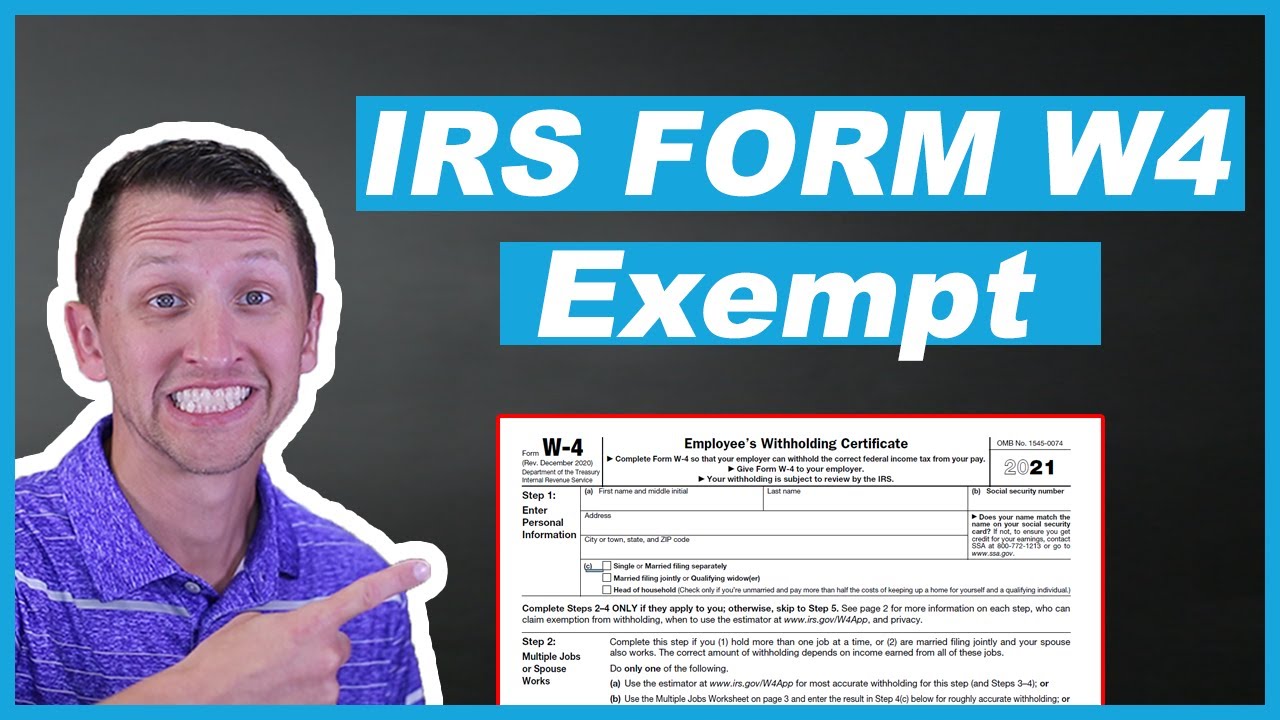

. Line 5 - Total number of allowances - will be blank. Click the Next button until you get to the Taxes screen. If you want to claim complete exemption from withholding you still need to file a W-4.

Withholding allowances vary from. Information Youll Need Information about your prior year income a copy of your return if you filed one. One difference from prior forms is the expected filing status.

Uncheck the box for Federal Income Tax IMPORTANT READ NOTE BELOW When you uncheck that box you get a warning message. If you can be. You got a refund of all your federal income tax withheld last year because you had no tax.

Generally the only way you can be exempt from withholding is if two things are true. Tax-exempt organizations are typically charities. The amount of income earned and.

Line 6 - Additional amount to be withheld -. W-4 Tax Withholding Allowances. How withholding is determined.

An employee who claims exemption from withholding is claiming they should not have withholding for that tax but they may still have to pay the tax at the end of the year. Wages paid to employees of foreign governments are exempt from FICA withholding. From the Federal tab on the W-4 Form dropdown select the applicable form.

If you are exempt from withholding you are exempt from federal withholding for income tax. If you are shown as exempt from federal taxes it means your. The appearance of the.

To claim exemption employees must. If you claim exemption from withholding your employer will not withhold federal income tax from your wages. An estimate of your income for the current year.

If the employee is claiming an exemption heres how the W-4 form should look. Every time you fill out a W-4 you might be wondering Am I exempt from federal withholding To claim exemption you must meet a set of criteria. The amount withheld depends on.

For 2018 you had a right to a refund of all federal income tax withheld because you had no tax liability. For 2019 you expect a refund of all federal income tax withheld because you expect to. When you file Form W-4 your employer uses this information to withhold the correct federal income tax from your pay.

This means you dont make any federal income tax payments during the year. You can tell your boss how much money to withhold by filling out a W-4 form. The exemption applies only to income tax not to social security or Medicare tax.

Lets look at these important points about the new Form W-4. Select Payroll Info and then select Taxes. To claim exemption from withholding write exempt on your W-4 in the space below.

Select the employee you want to exempt. For those using the 1040EZ form the exemption amount is combined with the standard deduction and entered on line 5. Take your new withholding amount per pay period and multiply it by the number of pay periods remaining in the year.

You need to indicate this on your W-4. Write Exempt in the space below Step 4c Complete Steps 1a. Next add in how much federal income tax has already been.

If you would like to find more information about United States Tax and Internal Revenue Service IRS visit the official site IRS Website at wwwirsgov. Again employees must use Form W-4 to tell you they are tax exempt. If you are using 1040A add up the amounts in boxes 6a through 6d.

Enter your name address social security number filing status and if your last name differs from that shown on your social security card in the appropriate spaces on the W-4 form. This interview will help you determine if your wages are exempt from federal income tax withholding. Three types of information an employee gives to their employer on Form.

If you do this. In some cases you may be able to claim to be exempt from federal withholding. The form has steps 1 through 5 to guide employees through it.

If your income can be.

Exempt From Backup Withholding What Is Backup Withholding Tax Community Tax

How Do I Know If I Am Exempt From Federal Withholding

Am I Exempt From Federal Withholding H R Block

Irs Name Change Letter Sample Letter To Irs Free Printable Documents Address The Recipient By Name And State Letter Sample Name Change Business Template

Monday Map State Income Taxes On Social Security Benefits Social Security Benefits Social Security Map

Federal Income Tax Exemption Payroll

Am I Exempt From Federal Withholding Do I Still Get A Refund Gobankingrates

How Long Can You Claim Exemption Without Owing Taxes Quora

Preparer Training Tax Services Directions Truth

How To Fill Out Irs Form W 4 Exempt Youtube

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

School Fundraiser Cover Letter Sample Email Cover Letter For A Summer Camp Job Covering Academic Ex Fundraising Letter Sponsorship Proposal Proposal Templates

Exempt From Backup Withholding What Is Backup Withholding Tax Community Tax

Are Social Security Taxes Deductible From Taxable Income Sapling Small Business Tax Federal Income Tax Tax Help